The implosion of cryptocurrency giant FTX continues to cast a long shadow, with the latest twist involving a Bahamas mansion and a plea deal. Ryan Salame, the former co-CEO of FTX Digital Markets, a subsidiary of the now-bankrupt exchange, has agreed to forfeit his luxury home on the Caribbean island as part of a criminal prosecution settlement.

FTX: The Spectacular Rise And Fall

Once a shining star in the crypto-verse, FTX boasted a valuation of $32 billion at its peak. However, the company’s house of cards came tumbling down in November 2022. Allegations of misuse of customer funds and mismanagement sparked a liquidity crisis, leading to the crypto exchange’s sudden bankruptcy filing. The collapse sent shockwaves through the cryptocurrency market, wiping out billions of dollars in investor wealth and eroding trust in the industry.

FTX Settles with Ryan Salame by exchanging a property in the Bahamas.

His settlement under his plea was for $5.6mm and his settlement to achieve that is by giving up a property in the Albany in the Bahamas worth $5.9mm (was paid for previously with a loan from FTX). pic.twitter.com/80eexcsEvW

— Mr. Purple 🛡️ (@MrPurple_DJ) May 1, 2024

Salame’s Bahamas Dealings

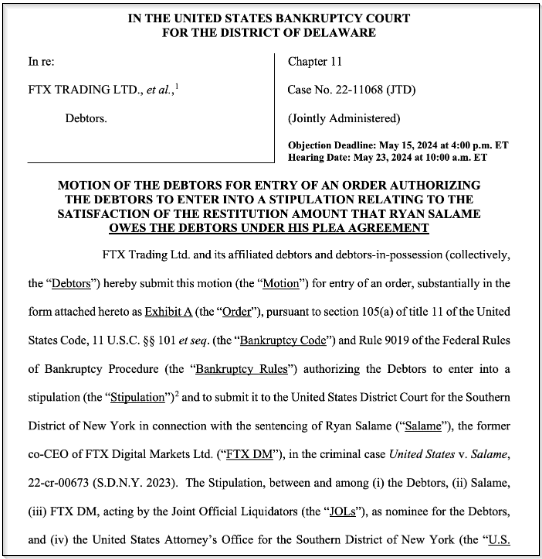

According to court documents filed by the company’s debtors with the Delaware Bankruptcy Court, Salame faces charges of conspiracy to make illegal campaign contributions, mislead election authorities, and operate an unlicensed money transmitter business. The filing also sheds light on a curious Bahamas property transaction.

A $5.9 Million House Financed By Alameda Research

The court documents allege that in September 2021, Salame agreed to purchase a $7.2 million mansion in the Bahamas. Notably, a 10% deposit for the property came from an account belonging to Alameda Research, another FTX affiliate implicated in the exchange’s downfall. Just two months later, FTX Digital Markets itself wired the remaining balance to Salame’s attorney from a Bahamas bank account.

Excerpt of US Bankruptcy Court vs Ryan Salame

Turning A Paradise Property Into Repayment

With Salame pleading guilty to the criminal charges, the plea deal offers a unique solution. Instead of a traditional cash restitution of $5.6 million, Salame will surrender ownership of his Bahamas residence to FTX debtors. This arrangement seems to benefit both parties.

Salame avoids the hassle and potential financial loss of selling the property in a currently sluggish Bahamas real estate market, where high-end sales volumes have reportedly dropped by as much as 25%. For FTX debtors, the mansion presents a tangible asset that can be liquidated to recoup some of the lost funds owed to creditors.

Total crypto market cap at $2.14 trillion on the daily chart: TradingView.com

Lingering Questions And Regulatory Scrutiny

The FTX saga continues to raise questions about the company’s internal financial controls and the conduct of its executives. Salame’s Bahamas property deal, funded by an FTX affiliate, raises concerns about potential conflicts of interest and the use of customer funds.

Related Reading: Will SocialFi Fizzle? Dogecoin Founder Expresses A Cynical View

Regulators worldwide are likely to scrutinize this case closely as they grapple with establishing a more robust framework for the cryptocurrency industry.

Featured image from Business Insider India, chart from TradingView